What does it do?

Kyber is an on-chain liquidity protocol that aggregates liquidity from a wide range of reserves, powering instant and secure token exchange in any decentralized application.

Key Features

- Kyber Network’s protocol is Platform-agnostic which means that any application or protocol may be powered by their liquidity network

- Instant settlement and no transaction uncertainty

- Ease of integration with different applications

- On-chain and fully transparent

General information

| Company Name | KYBER NETWORK PTE. LTD. |

| Incorporation date | 13/07/2017 |

| Incorporation Address | 8 EU TONG SEN STREET #15-90 THE CENTRAL SINGAPORE (059818) |

| Website | https://kyber.network/ |

| Blog | https://blog.kyber.network/ |

| Phone | n/a |

Economic details

| Initial Funding & Distribution | |

|---|---|

| Ticker | KNC |

| Token Type | ERC-20 |

| Total Supply Sold | 138 000 000 KNC |

| Total Amount Raised | 52 000 000 USD |

| Price During the Crowdsale | 0.38 USD |

| Hard Cap | 46 000 000 USD (raised 13% more) |

| Whitepaper | https://whitepaper.io/document/43/kyber-network-whitepaper |

| Token Distribution | 61.06% Public 19.47% Company 19.47% Founders/Advisors/Seed Investors |

| Funds Distribution | 50% Reserve (26M USD) 30% Development (15.6M USD) 10% Legal/Mark (5.2M USD) 10% Operations (5.2M USD) |

| Crowdsale Date | September 16, 2017 |

| Sources: https://icodrops.com/kybernetwork/ https://messari.io/asset/kyber-network | |

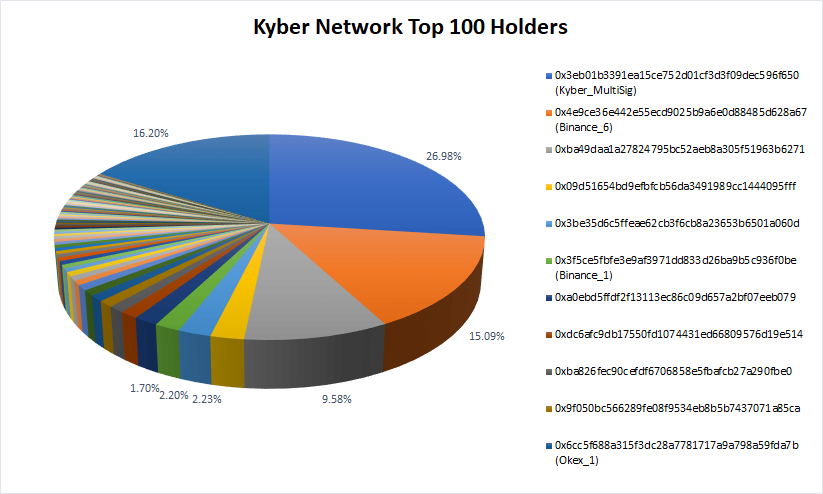

Source: https://etherscan.io

https://tracker.kyber.network/#/

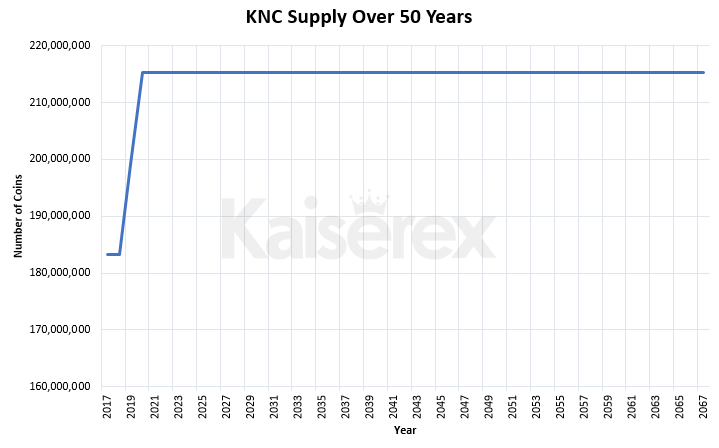

This chart does not account for burned KNC tokens(from collected exchange fees) in the future.

Social Media

|  |  |  |  |  |

Team

| Title | Name | ||

|---|---|---|---|

| Co-founder & CEO | Loi Luu |  |

| Co-founder & CTO | Yaron Velner |  |

| Co-founder & Head of Development | Victor Tran |  |

| CFO | Myra Loh | n/a |

Development

| Total number of Commits | 11 425 Commits (32 Repositories) |

Partners

Mossland – a blockchain gaming company where you can purchase virtual real-estate and trade it.

Trust Wallet – a wallet for Ethereum, ERC-20 and ERC-223 tokens.

Icon – a decentralized network which connects blockchain companies to institutions that are not related to cryptocurrency.

StormX – is the creator of Storm Play (formerly known as BitMaker), and Storm Market, with gamified micro-tasks.

Request Network – a decentralized network for payment requests.

MyEtherWallet – an interface for generating Ethereum wallets.

Coinmanager – a cryptoassets management service.

Competitors

0x protocol – is an open protocol that enables the peer-to-peer exchange of assets on the Ethereum blockchain.

Shapeshift – a platform for instant swaps between assets.

faa.st – a platform for instant cryptocurrency trades.

Binance – a centralized cryptocurrency exchange with high liquidity.

Bittrex – a centralized cryptocurrency exchange with high liquidity.

Potential market and clients

The potential depends on the trust of centralized exchanges because they directly compete with decentralized exchange protocols, such as Kyber Network. Market will decide if it needs more autonomous exchange solutions or simply rely on some well managed centralized exchanges. The main clients that need access to liquidity are individuals, DApps, vendors, payment gateways, decentralized funds.

Utility and economic dynamics

- KNC tokens are required to operate as reserves because they are paid to the network as fees.

- Projects that have integrated Kyber can earn a commission as part of the fee sharing program for directing trades from their platforms.

- The remaining fees collected (after paying for the operation expenses and distribution for the fee sharing program) are burnt.