CRYPTO5 portfolio was created in 2016.01.01 and offered to Kaiserex’s clients.

It was made public in 2016.12.12 on:

https://uzdarbis.lt/t377337/investavimas-i-kriptografines-valiutasbitcoin-ir-kt/

and 2017.01.09 on:

https://bitcointalk.org/index.php?topic=1744991

Performance can be proven and tracked back by checking online records at these forums.

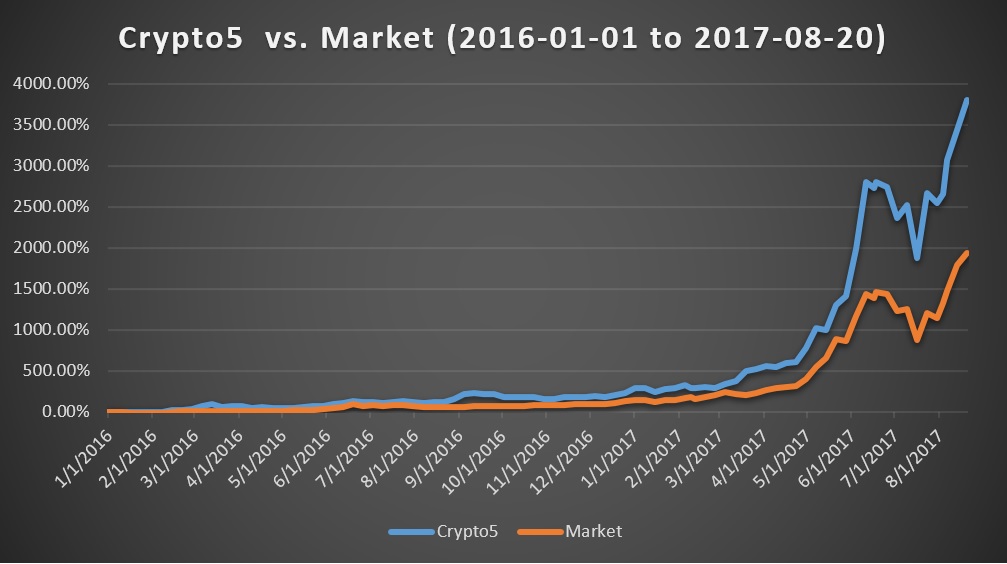

During the last 20 months recommended CRYPTO5 portfolio was one of the best in its class. Since 2016 the fund appreciated 3796,27% of cumulative returns (the market was up by 1934,48%). Over the time given the fund outperformed market by 96%. The selected cryptocurrencies proved their expected potential.

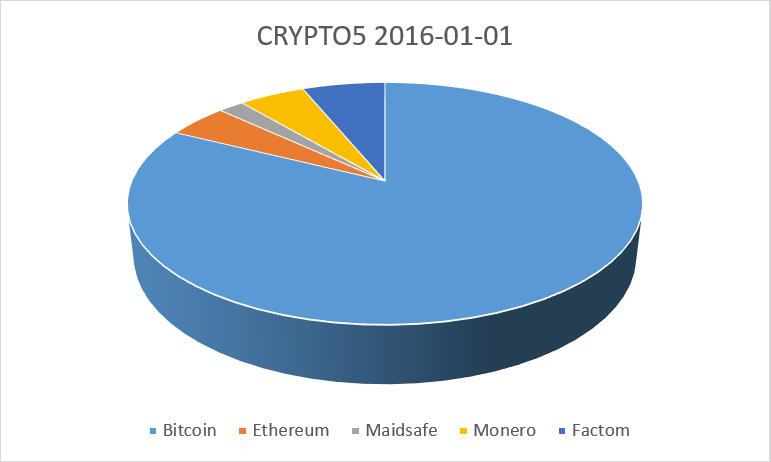

After long selective research 5 constituencies were chosen: Bitcoin, Ethereum, Monero, Maidsafe and Factom. In the graph below you can see the weightings of coins:

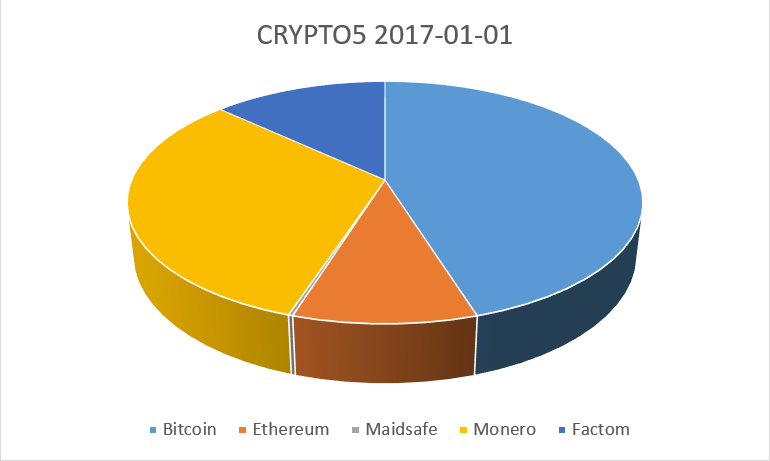

After 1 year weightings changed accordingly:

Throughout 2017 CRYPTO5 fund was actively managed. The year started with China suspending its local exchange currencies from BTC/CNY trading. By acting early on, we sold out Bitcoin to fiat and made reverse exchange 30 days later as China’s companies resumed trading. Another major fund’s change was related to Ethereum technical network issues. In mid-June all Ethereum (at the price of $340) was exchanged to Bitcoin and never came back to the portfolio. It is also worth to mention that our clients’ Bitcoin Cash (BCH) coins were sold off on 3rd of August – well ahead of all other exchanges even supporting any trading of BCH. Majority of Kaiserex’s clients have copied our actions by replying with a YES to our emergency notification emails and achieved the same results.

Buy and hold strategy outperformed any other trading set up. Funds that have chosen to employ automated strategies based on algorithms have lagged passive strategies by 3 to 5 times in the last 2 years. Multi-year capital inflows into crypto currencies market has not paused yet. According to our estimates, large institutional entities are going to lift up the market even higher by the end of this year. So, what I mean by saying this, is that algorithmic, hedging and active management strategies are not yet suited for this market. The most gains comes from early investments to innovative and high potential blockchain related cryptocurrencies.

Now let’s compare CRYPTO5 and crypto market results starting from 2016:

CRYPTO5 has clearly outperformed its benchmark crypto market:

| CRYPTO5 | MARKET | |

|---|---|---|

| Return since 2016 | 3796.27% | 1934.48% |

| Annualized Return | 833.89% | 528.26% |

| Largest weekly decline | -24.49% | -27.72% |

| Largest weekly increase | 39.96% | 32.81% |

| Largest peak-to-trough | -24.49% | -37.44% |

Now let’s sum up the performance. CRYPTO5 annualized return was 833,89% in comparison to only 528,26% of market gains.

The biggest CRYPTO5 weekly decline was -24.49% while market’s worst week accounted for -27,72%. The biggest weekly upside swing for the fund was 39,96% and the market’s highest mark was +32,81%.

The maximum peak to through decline for the fund accounted -24.49%. On the other hand, the whole market had major -37,44% decline.

This is highly associated with the fact that CRYPTO5 did not participate in any ICO or overvalued and low potential crypto assets. The currencies chosen show robust growth during the whole period. However, some of them due to various reasons are in their late growth’s period and were sold out to the market.

We are proud to mention that the fund had lower risk and higher return than the market since its inception. Thanks to perfect selection of high potential growth cryptocurrencies (not ICOs) during the last 2 years we earned trust from our clients.