- Market capitalization is incorrect for most cryptocurrencies

- Over 20% of the current Bitcoin supply is probably lost

- New market capitalization methodologies are starting to arise

Why knowing the market cap of a cryptocurrency is important

Simply knowing the price of a cryptocurrency does not give you a lot of information. Market capitalization is much more important in understanding how a coin is performing. It serves as a starting point to compare and value a cryptocurrency because it represents how much a network is actually worth and makes it easier to quickly and accurately compare cryptocurrencies. It does, however, have its own shortcomings.

Problems with current market capitalization

Market capitalization on coinmarketcap.com and various similar websites is misleading. It is calculated by using this simple formula:

Market Cap = Price * Circulating Supply

The more coins in supply, the bigger the market cap. The problem with this calculation is that over time coins get lost – some of them are stuck in various smart contracts or held by a foundation with a time lock. This explains why forked cryptocurrencies such as Bitcoin Cash or Bitcoin Gold have such large market cap even though it is not even close to their real market capitalization.

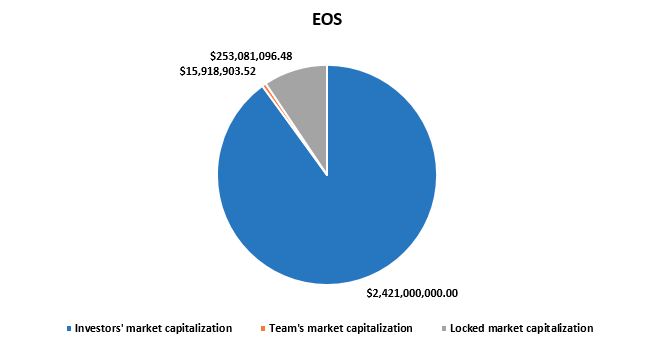

Another problem is estimating the market cap of an ICO, in which usually 20% to 50% of the total supply is controlled by a development team or some sort of foundation. Far more useful would be to introduce different types of market caps for ICOs such as:

- Investors market capitalization = Coins that investors hold * Price

- Team’s market capitalization = Coins that team currently holds * Price

- Locked market capitalization = Coins that are time locked * Price

- Ratios and % charts in comparison to total market capitalization

Examples with EOS and Elastos ICOs

Adjusted market capitalization

Our approach for a more realistic market cap is:

Adjusted Market Cap = Price * Active Coins in Circulation

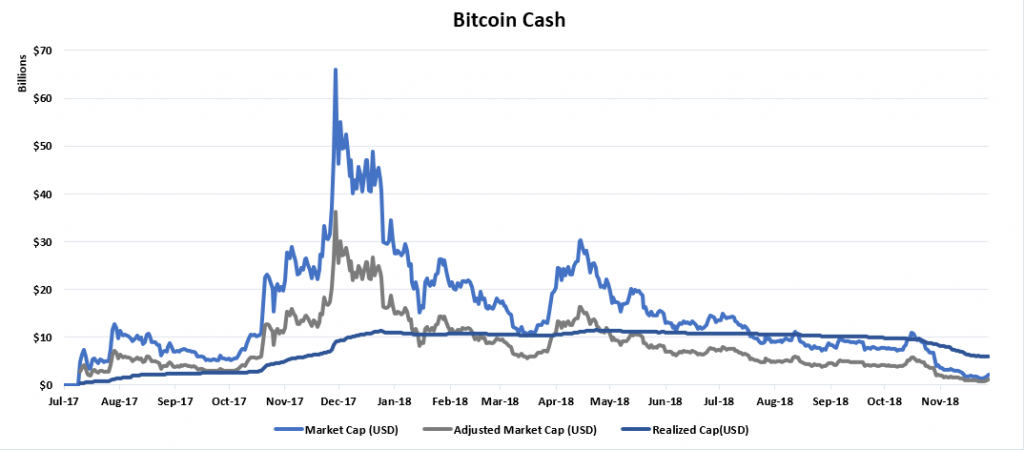

We analyzed Bitcoin Cash blockchain and found that 9.26 million BCH coins have been claimed since the fork of 2017.08.01. We consider these to be Active Coins in Circulation. Coinmarketcap.com, on the other hand, shows 17.52 million BCH in circulation (a 47.1% discrepancy). This is an impossible number when taking into account that roughly 4 million BTC is considered to be lost. (source:https://www.ccn.com/6-million-bitcoin-is-lost-or-stolen-should-the-real-value-of-btc-higher/)

A more realistic valuation of the BCH market cap would be to multiply the current circulation of 9.26 million with its current price. The longer it takes a user to claim a forked coin, the less likely they are to be claimed at all unless the price rises significantly.

Realized market capitalization

On December 14th coinmetrics.io announced their new realized market cap methodology. (source: https://coinmetrics.io/realized-capitalization/)

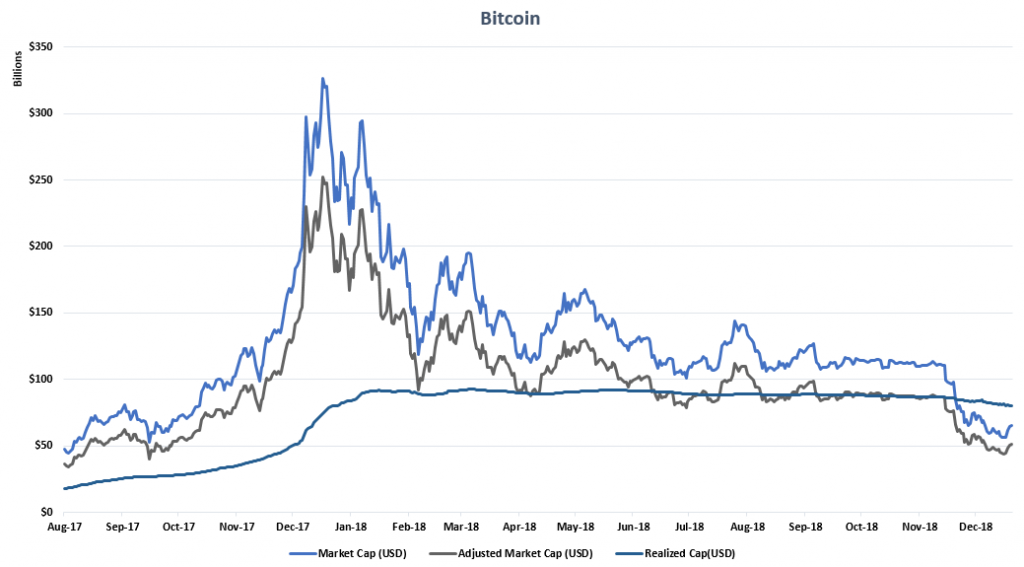

Their approach tries to discount lost coins, but in a different way. They calculate the market cap by valuing different parts of the circulating coin supply at historical prices they were traded at. It sounds complicated because it actually is. A more in depth explanation can be found at https://coinmetrics.io/realized-capitalization/

This methodology benefits from using historical context. For example, if the price of Bitcoin dropped to $1000 and stayed at this price for a month and only a small amount of coins were traded at that price, the realized market cap would barely change at all. This makes a lot of sense and it works well because realized capitalization accounts for historical prices and transaction activity during that time.

However, upon review it’s clear that this type of market cap estimation is useful only with older cryptocurrencies such as Bitcoin and Litecoin and can be seriously misleading with forked coins such as Bitcoin Cash or Bitcoin Gold.

Comparison of market capitalization methods

This BTC comparison shows that realized cap is probably the most realistic estimation of Bitcoin’s capitalization. Its value didn’t go through the roof during the bull market in 2017 and it is relatively stable now.

Adjusted Market Cap simply removes lost BTC (4 million) from the circulation and shows an alternative valuation.

Regarding forked coins, we can see that adjusted market capitalization works much better and gives a realistic estimation of the network value because it accounts for only active coins that have been claimed after the fork. Realized capitalization, on the other hand, is completely wrong in this situation and is even higher than the traditional market cap.

Conclusion

It is important for investors and speculators to understand how market capitalization is calculated and what drawbacks such calculations hold. Having accurate data is crucial for making any financial decisions.

As the cryptocurrency market keeps evolving, pricing and market data will become more reliable and more sophisticated as well. New estimation models will be coming in to play and more blockchain analysis tools will be built.