The recent crash of more than 40% in the price of Bitcoin caused a lot of uncertainty in the market. This was a huge hit to not only the investors, but also the miners. Dovey Wan, founding partner at Primitive, was one of the first ones who raised the awareness of what is happening in China and tweeted a video explaining that due to the crash it became unprofitable for the small miners to operate.

BRUTAL: this is what’s happening now in a China based mining site …. 😨😨 pic.twitter.com/gcN4lVTyBt

— Dovey Wan 🦖 (@DoveyWan) November 20, 2018

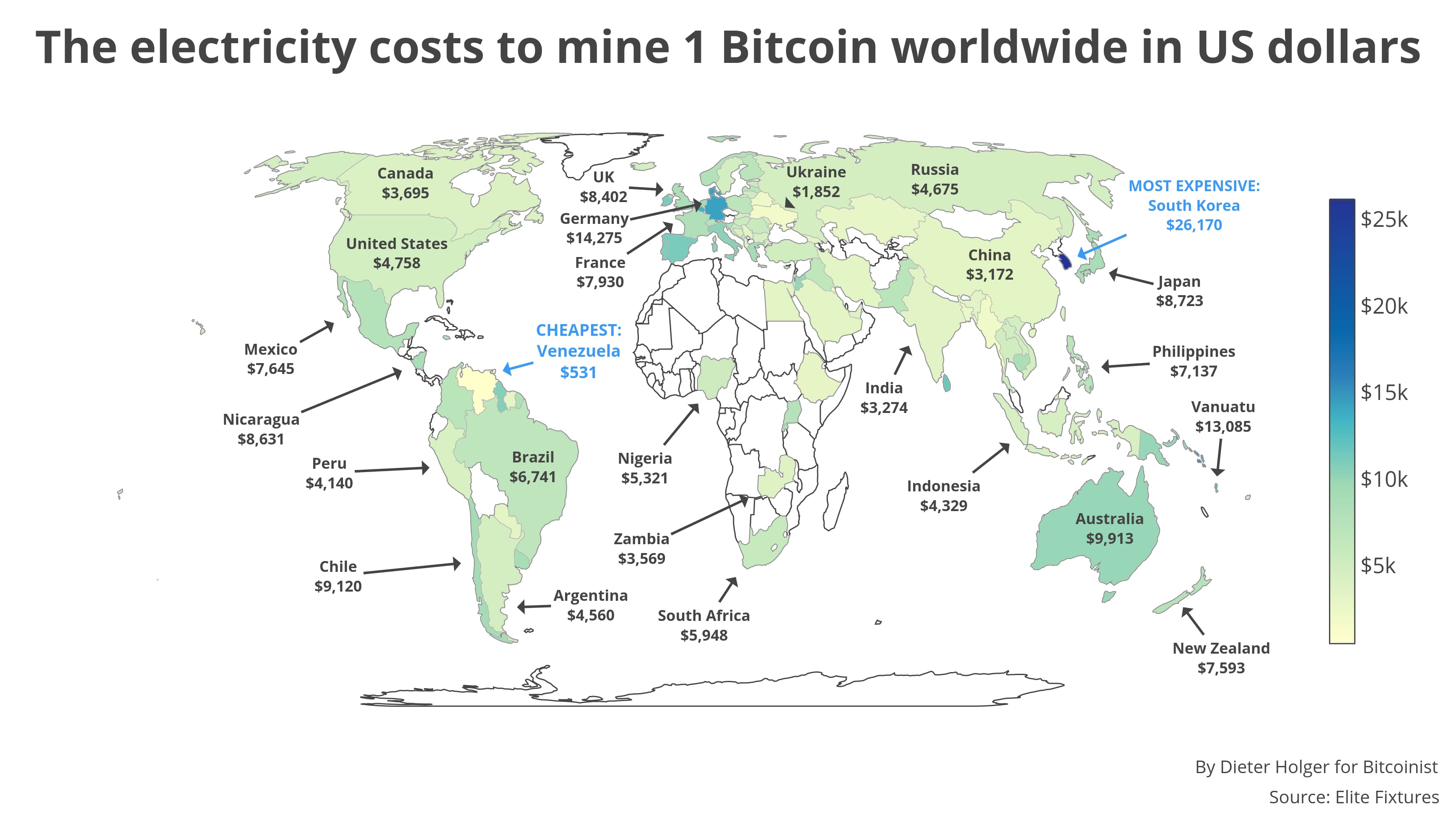

Miners are an essential part of Bitcoin’s ecosystem as they participate in a proof-of-work which is crucial for transacting Bitcoin. In a mining business just like in any other there are two main factors that affect the profitability: the revenue (the value of Bitcoin mined) and the costs of running the business (incl. the cost of electricity). There is a highly positive correlation between profitability, number of miners in the network, difficulty, hash rate and security of the network. Once the value of Bitcoin drops or the the price of electricity increases it become harder for small miners to profit or at least break-even (the chart bellow compares the price of electricity to mine 1 BTC all around the world).

Source: Elite Fixtures

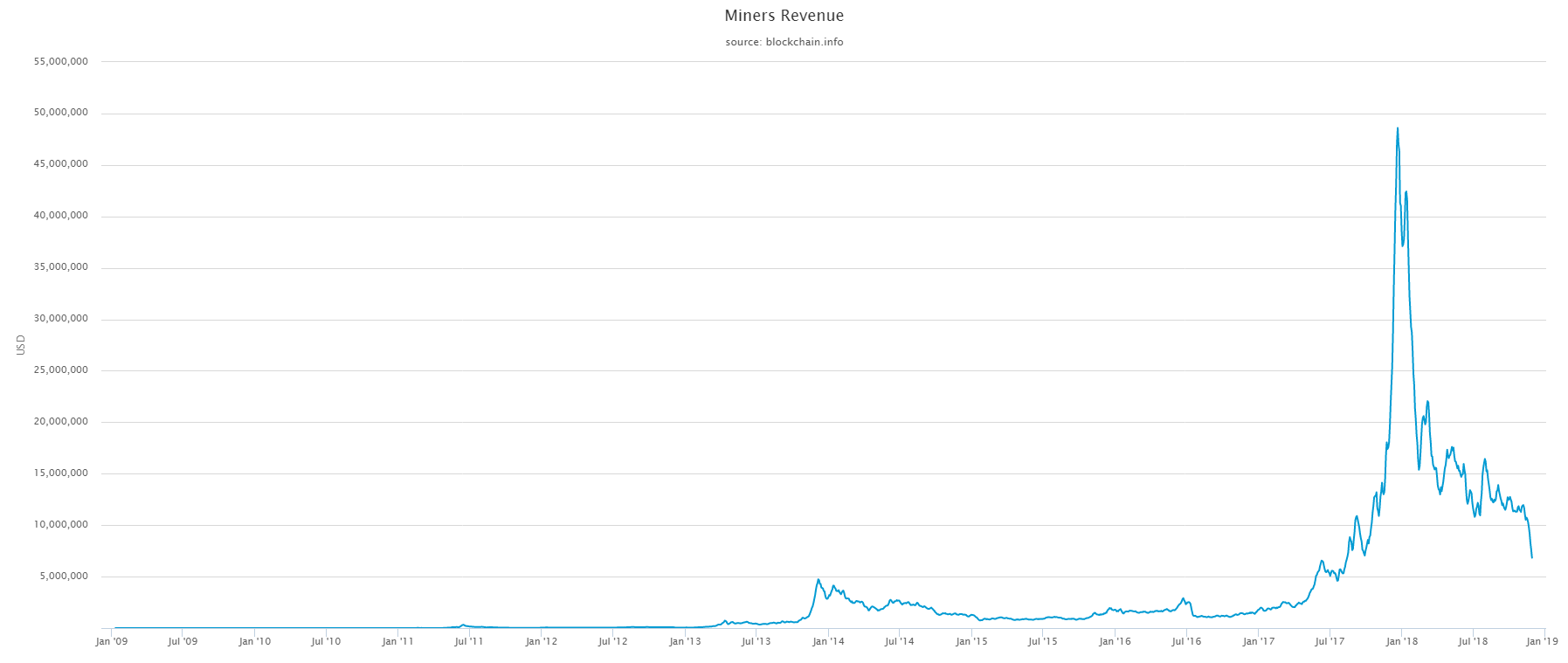

The revenue of mining was increasing over time (graph bellow) so, it all depends on when they got in the business and how they managed their profits. Also, it might be a perfect time for miners to expand their position in the market by purchasing mining facilities at a discount or clearing the old and more wasteful technology.

Source: www.blockchain.com

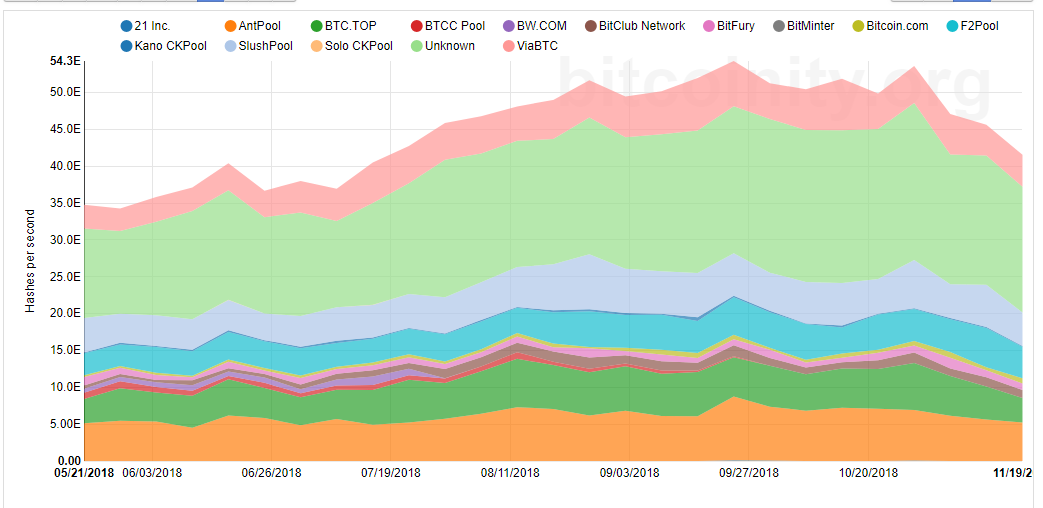

Decrease in miners last week resulted in Bitcoin’s network hash rate drop. This means that the network became slower at processing transactions until the next difficulty adjustment comes. Difficulty adjusts every 2016 blocks and one block should take around 10 minutes. If hash rate drops 50%, the block will statistically be mined twice slower. This is a self regulating system and it resolves itself pretty well.

Source: data.bitcoinity.org . This graph shows weekly data.

Effect on Security of the Network

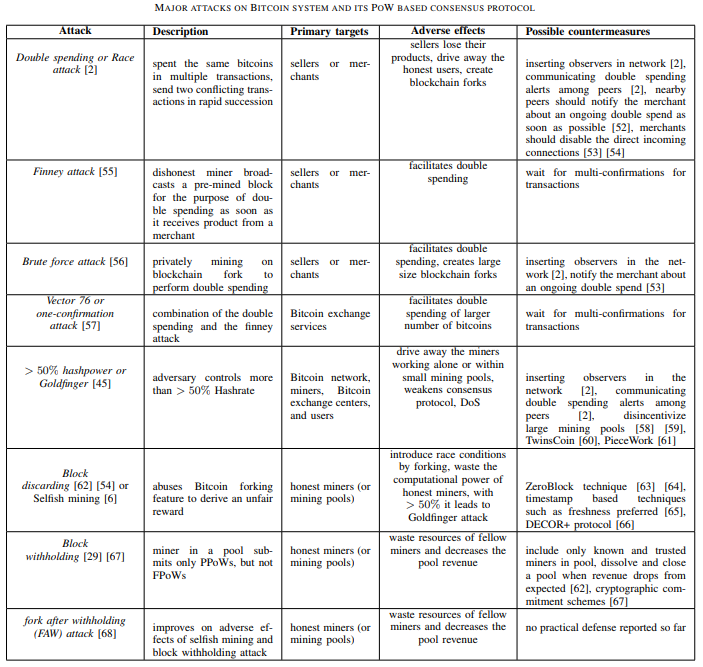

The decreased number of miners raises the threat of an attack such as >50% hashpower (the graph bellow). This attack may have the most harm to Bitcoin network because bad actors by gaining >50% hash rate may try to take actions such as claim all the block incentives, perform double spending, reject or include transactions as preferred, this could potentially have a high impact on every user in the network.

The most recent analysis showed that it would cost 1.4 billion USD to execute such an attack. Malicious actors would have either built their own facilities (it would require 2.4 million of the most advanced ASIC computers, infrastructure, buildings, labor, ventilation and etc.) or co-operate with the existing Bitcoin miners that have such facilities.

It is hard to imagine any entity gathering such an amount of funds to try execute such an attack. Some say that the most realistic possibility would be China’s government enforcing the Chinese miners to do it (as 70-80% of miners are located in China).

Even though it is unlikely to happen users are cautious of it. Therefore, in July 2014 when mining pool ghash.io exceeded 50% of the bitcoin network’s computing power it voluntary reduced to bellow 40%. 51% attack is more realistic to be happening on other cryptocurrencies with smaller networks as for instance it happened to Bitcoin Gold in May,2018.

Conclusion

Bitcoin miners are in a declining business cycle phase right now where they have to adapt to the changing business environment by implementing various business strategies. Some of the strategies may be to get rid of inefficient rigs, pause the mining until market recovers to a certain level, move business to a location where the production costs are lower, etc. Some businesses may completely exit the market.

Bitcoin network is still the most secure network in the world and even if 51% attack would happen it would be only a try to attack with unlikely successful outcome. A similar 51% attack happened last year, when Bitcoin was forked and B2X had more than 50% of hash power, markets simply decided not to value B2X at a high price – Bitcoin did fine, attackers lost millions and capitulated.