Regulations

United States

Congress members asked SEC chairman Jay Clayton to clarify the regulations on cryptocurrencies.

Mexico

Cryptocurrency exchange have to request for an authorization from the Central Bank of Mexico. They have to provide their detailed business plan that includes operations, commissions, KYC, etc.

Market capitalization

On the 1st of September the was 227 297 448 855 USD in the crypto market (according to coinmarketcap data).

On the 30th of September the market cap was 220 837 915 754 USD.

The loss of capital was around 2.84%.

Hacks

Japanese cryptocurrency exchange Zaif was hacked on the 17th September and lost around 59M USD.

Two of the EOS top dApps, EOSBet and DEOSGames were hacked and over 260 000 USD were stolen.

It was not a hack, but worth mentioning that there was a mayor vulnerability in Bitcoin was stopped. The hackers could have inflated the supply of Bitcoin.

Crypto market performance comparison to other assets

| September | |

|---|---|

| Bitcoin | -8.65% |

| S&P 500 | 0.60% |

| Crude Oil WTI | 4.46% |

| Gold Futures | -1.23% |

| US 10Y Bond | 7.09% |

| Crypto Market | -7.38% |

Source: investing.com. Calculations do not include data on weekends.

Correlation

| Bitcoin | S&P 500 | Crude Oil WTI | Gold Futures | US 10Y Bond | Crypto Market | |

|---|---|---|---|---|---|---|

| Bitcoin | 1 | |||||

| S&P 500 | 0.24 | 1 | ||||

| Crude Oil WTI | 0.17 | 0.77 | 1 | |||

| Gold Futures | -0.15 | 0.26 | -0.03 | 1 | ||

| US 10Y Bond | -0.38 | 0.82 | 0.73 | 0.11 | 1 | |

| Crypto Market | 0.92 | 0.41 | 0.39 | -0.21 | -0.13 | 1 |

Source: investing.com. Calculations do not include data on weekends.

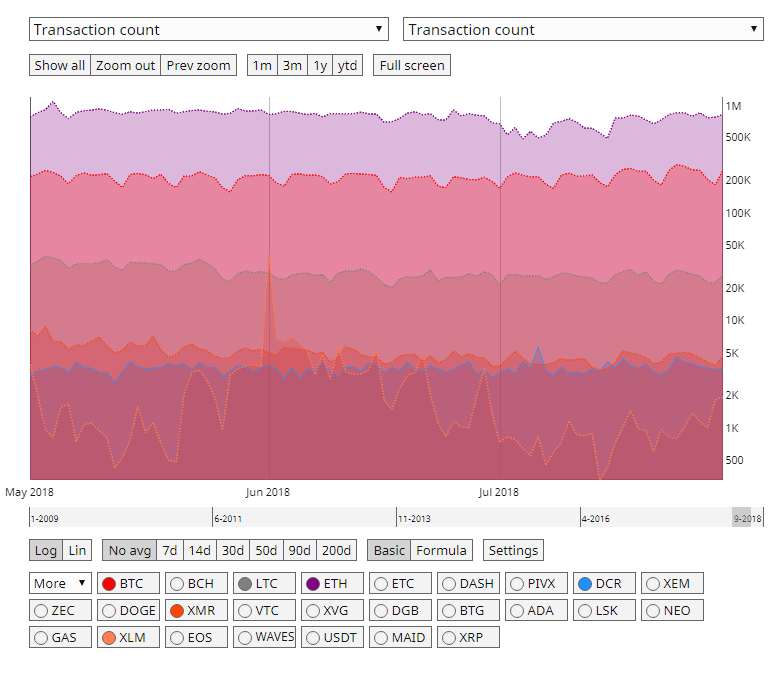

Transactions

Source: coinmetrics.io.

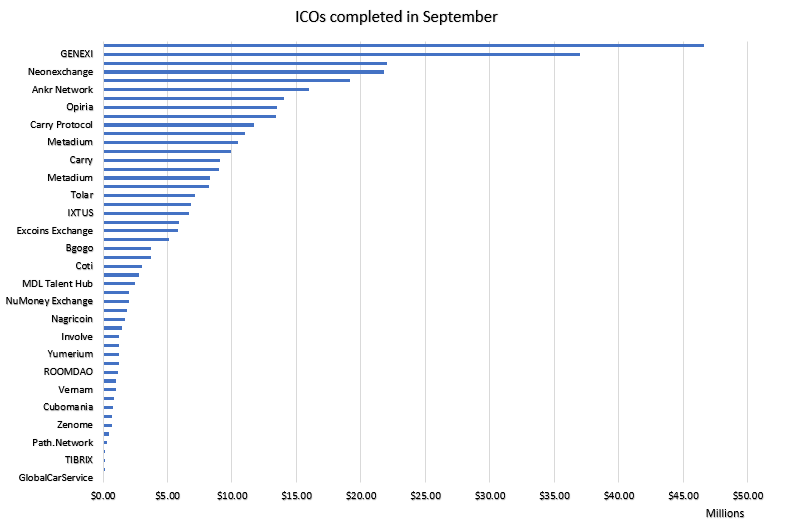

ICOs

The total number of ICOs completed in September was 128 (58.59% have not published the results). The total amount raised is equivalent to 356 064 319 USD.

This graph does not include ICOs that raised less than 100 000 USD.

Sources: https://www.icodata.io/, https://icobench.com/, https://icodrops.com/.

In comparison to August ICOs raised approx. 31.13% less, however, the total number of ICOs was smaller by 11 (according to data gathered by us in August).

Summary

The market was shrinking so as all the value in the investment. There were no strict regulations introduced or any other event which could have caused a lower confidence in the market. The total market capitalization decreased by 2.84% while S&P 500 outperformed Bitcoin by 9.25%. ICO market shrank indeed there were 7.38% reduction in launched ICOs, sequentially, 31.13% less capital raised.