What kind of asset is Bitcoin?

While deciding whether to invest in cryptocurrencies or not, we strongly advise you to analyze basic parameters of this new asset class.

According to Robert J. Greer various assets may be classified in the following order:

- Capital assets. Generates cash flows (stocks, bonds).

- Consumable transferable assets. Can be consumed or transformed into another asset (physical commodities).

- Store of value assets. Does not generate cash flows, are not consumable but still has relatively stable purchasing value.

Because of the fact that cryptocurrencies do not have cash flows and you are not able to consume them, they can only be characterized as store of value assets. This kind of assets usually hold value as long as other market participants share a demand for that. They are sometimes called “safe haven assets” as well. Traditional safety assets are gold, Swiss franc or Japanese yen.

Bitcoin being a cryptocurrency shares the main features as gold: has limited supply, has high mining costs and is treated as an asset that works well while saving purchasing power.

Moreover, cryptocurrencies attract investors with its extremely low correlation to other investments. It is not correlated neither to stocks, neither to gold. It is one of the best tools to reduce portfolio volatility and increase Sharpe ratio.

Bitcoin proved to be a hedge against geopolitical events, government restrictions (capital controls in China) and inflationary monetary policy after the crisis.

What is bitcoin’s correlation with other financial assets?

Modern portfolio theory suggests that an investment’s risk and return characteristics should not be viewed alone, but should be evaluated by how the investment affects the overall portfolio’s risk and return. In order to construct portfolio that maximizes risk with a given level of risk, investor should select multiple assets that are the least correlated among each other.

As we discussed before, bitcoin and other cryptocurrencies are a nice hedge against distrust in financial markets. Bitcoin as gold is one of the assets that people tend to buy during the times of loss of trust in monetary policy actions (Cyprus), economic downturns (Venezuela) and uncontrolled inflation (Zimbabwe, Argentina). It is common practice to have gold or bonds in portfolio as a hedge during meltdowns in stock market. However, our fund states that having Bitcoin can optimize your portfolio volatility as well.

| Daily Return Correlation | S&P 500 | US 10Y Bond Yield | Crude Oil WTI | Nasdaq100 | Gold Futures | US Dollar | Bitcoin |

|---|---|---|---|---|---|---|---|

| S&P 500 | 1 | ||||||

| US 10Y Bond Yield | 0.31 | 1 | |||||

| Crude Oil WTI | 0.10 | 0.06 | 1 | ||||

| Nasdaq100 | 0.82 | 0.10 | -0.02 | 1 | |||

| Gold Futures | -0.27 | -0.53 | 0.06 | -0.12 | 1 | ||

| US Dollar | 0.23 | 0.50 | -0.02 | 0.14 | -0.51 | 1 | |

| Bitcoin | 0.05 | 0.00 | -0.01 | 0.06 | 0.03 | 0.04 | 1 |

The table of various assets classes correlations shows that Bitcoin has very weak links to other asset classes. Data is based on one-year daily returns correlation between different financial products. The Bitcoin correlates to other assets just around the value of 0. That is extremely low and very hard to find in nowadays financial markets as QE effected various assets move in one direction.

Basically, Bitcoin neither has correlation with different asset classes, neither with store of value assets. This is a must-have component to any portfolio that already has bonds, safe haven currencies and gold. According to the data, digital assets seem to have their own ecosystem and do not react to real economic cycle swings. These outcomes strongly suggest that Bitcoin is a unique, uncorrelated asset class that is not directly affected by the real economic swings that drive most asset classes.

Due to its decentralized nature Bitcoin has some strong theoretical arguments that this digital asset may serve as a hedge to big geopolitical events, distrust in monetary policy or some other world order changes.

Is there a bubble already?

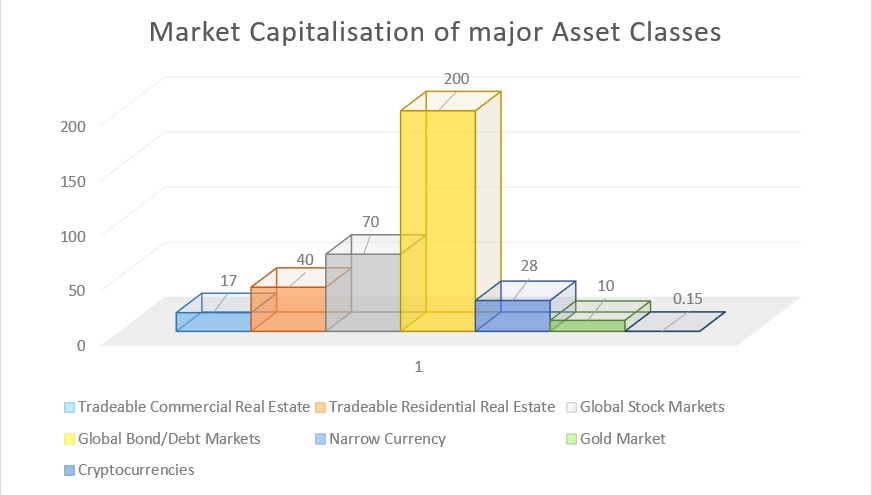

Mass media called Bitcoin dead more times than any other asset class during the last 5 years. It is true that ICO utility tokens look fairly overvalued but it is only one side of the coin. According to CNBC data, cryptocurrency bubble is likely to happen but it may be far away in the future. Taking into account that all cryptoassets combined sum up to less than $200 billion, it is still only about 1.25% of the money burst during Dot-com Bubble.

The market cap of all cryptocurrencies is so small that it really does not have any impact on global financial markets risk. There is just the same number of crypto users as of internet in 91/92. Hence, there is still plenty of room for new investors and promising blockchain companies to come. Investors always share high volatility argument against Bitcoin investment. No doubts about short term ups and downs in the crypto market – volatility may stay here for longer.

But that is really not the case. Even if the market during last 25 months had 10 crashes of about -35% to -45%, the value of the tokens has increased at least 25 fold. Annualized rate of growth is 720,10% versus 148,08% last year.

This brief analysis has a purpose to inform that new digital assets may significantly improve your portfolio’s health as it is highly uncorrelated to other asset classes and ten to move differently from macroeconomic fundamentals. Cryptocurrencies are the opportunity not to miss. Price volatility has decreased substantially past two years as the market is getting more mature. The end of this year and the start of 2018 will be marked with mass investments from newly professionals launched crypto funds. So, it seems that wind blows in a positive direction for cryptocurrency holders. Go with the best and have a share in on of the biggest opportunities over the past decade.