UPDATE: This service has been discontinued on 2017 November 24th and an alternative service will be offered to all Kaiserex’s clients

Crypto market is a very fast-paced market and every minute might cost a lot. The majority of customers do not follow the markets 24/7, hence, an emergency notification service gives them an advantage against other investors. Considering that our own funds are invested in this market we monitor it as best as we can on a daily basis, therefore, we send our clients a warning signal beforehand. Moreover, you do not have to worry about the commission fee as in those circumstance it is as low as 1%.

Making these investment decisions had a significant impact on our portfolio performance and helped us outperform the cryptocurrency market by 96%.

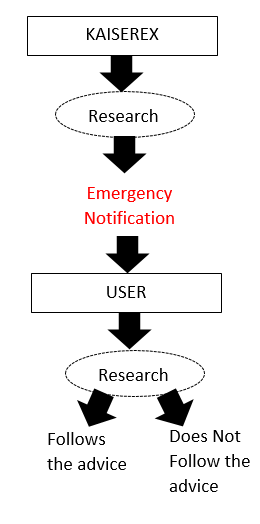

It is crucial for every investor to understand how this service might significantly protect their investments, however, there is no guarantee that our emergency notifications will have an impact as we expected. Hence, the final decision has to be made by an investor itself (annex 1).

Annex 1. A simplified procedure of the emergency notifications.

Emergency notification log

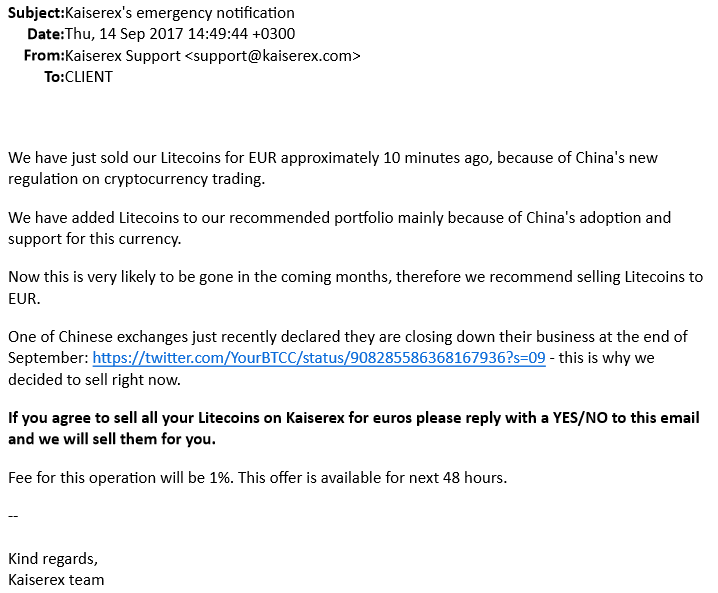

On the 14th of September 2017 we sent an emergency notification to our customers warning them about the possible price drop in Litecoin due to China’s new regulation on cryptocurrency trading:

Investors who followed the advice avoided a crash of 31% (blue line in the annex 5).

Annex 2. Source: Investing.com.

However, as it was mentioned in the beginning the market not always reacts to all the shocks, hence, there might be no negative effect on the price.

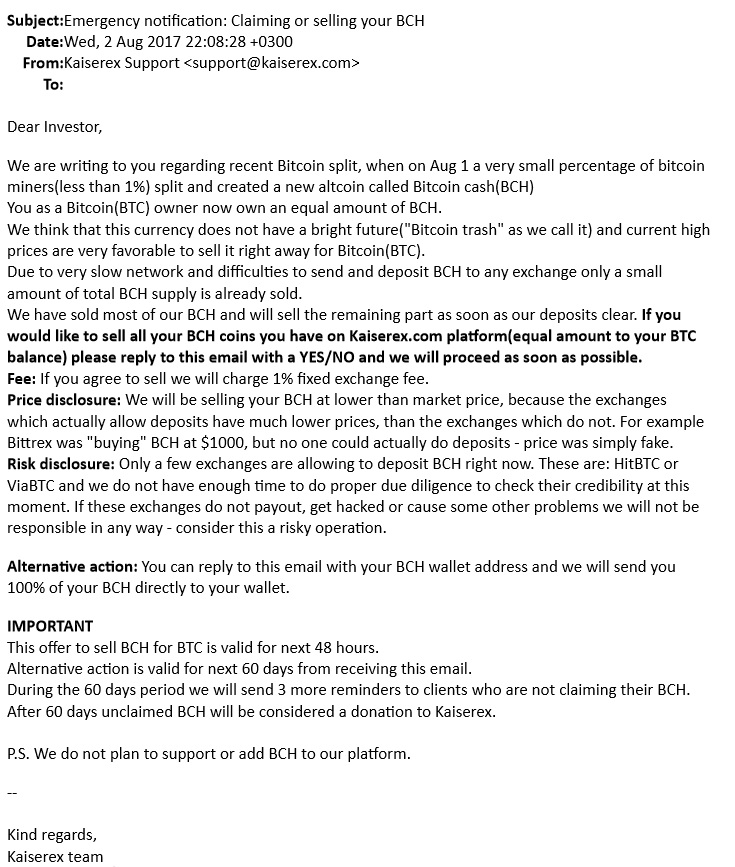

On the 2nd of August 2017 we sent an emergency notification to our customers warning them about the possible price drop in Bitcoin Cash due to a recent Bitcoin split:

Investors who followed the advice avoided a crash of 47% (blue line in the annex 3).

Annex 3. Source: Investing.com.

Meanwhile, shifting to BTC helped investors to face at least 1.6-fold increase in their investment (blue line in annex 4).

Annex 4. Source: Investing.com.

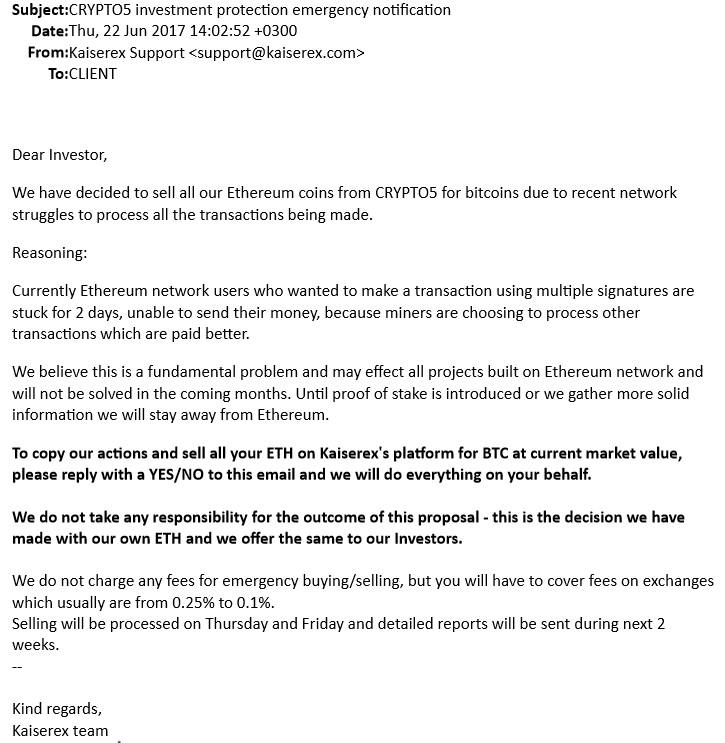

On the 22nd of June 2017 we sent an emergency notification to our customers warning them about the possible price drop in Ethereum due to technical network problems and scalability issues:

Investors who followed the advice avoided a crash of 46% (blue line in the annex 2).

Annex 5. Source: Investing.com.

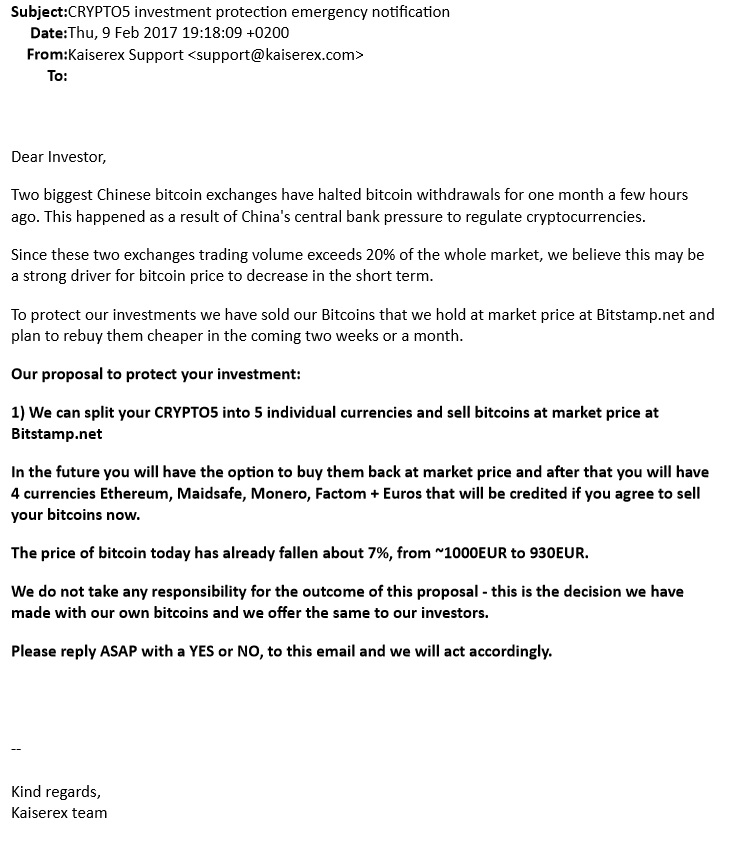

On the 9th of February 2017 we sent an emergency notification to our customers warning them about the possible price drop in Bitcoin due to China’s central bank pressure on regulation of cryptocurrencies:

Usually, the value of cryptocurrencies is extremely sensitive to all the possibilities of the increase in regulation. Investors who followed the advice lost the potential gain of around 30% (blue line in the annex 6). We bought BTC back on the 10th of March 2017, investors lost 18.5% of their Bitcoin.

Annex 6. Source: Investing.com.